Double Entry

System of Accounting

Double entry system of accounting is based on the dual

aspect concept. It includes two aspects, they are Debit aspects and Credit

aspects.

Debit Aspects- This includes either Receiving aspects,

incoming aspects or Expenditure aspects, these are known as Debit aspects.

Credit Aspects- The another aspects may be Giving aspects,

outgoing aspects or income aspects. These are known as Credit aspects.

Stages of Double Entry System

There are three distinct stages are includes a complete

system of double entry.

i)

Recording of transactions in the journal.

ii)

Posting of journal entry in to the respective

ledger accounts and then preparing a trial balance.

iii)

Closing of books of accounts and preparing final

accounts.

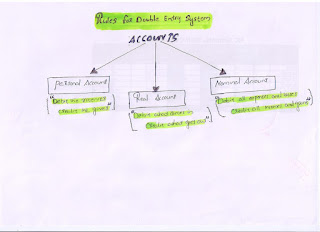

Rules for Double Entry System

An account is statement and it is a record of transactions

relating to a person, or a firm, or a property, or a liability, or an income or

expenditure. There are three kinds of rules for double entry system. They are

as follows:-

1.

Personal Accounts

Under this statement, a separate account will

be prepared for each person. It includes Natural peron’s account, Artificial

person’s account and representative personal accounts. Some of the examples of

personal account are Ramu’s account, Bank account, Any firms account, any

companies account, prepaid expense account, outstanding wages account etc.

Rule for personal Account:-

“Debit

the receiver

Credit the giver”

2.

Real Accounts

Under the real account, a separate account

will create for each class of property or asset. There will have an account

relating to a property, an asset or a possession of property. Some of the

examples for real account are Cash account, Furniture account, Goodwill account

etc.

Rule for Real Account:-

“Debit

what comes in

Credit what goes out”

3.

Nominal Account

These includes the expenses and losses or

incomes and gains of business. Some of the examples of Nominal account are

wages account, discount received account, interest account etc.

Rule for Real Account:-

“Debit

all expenses and losses

Credit all incomes and gains”

Advantages

of Double entry system

The important merits of Double entry system

are as follows:-

1.

Under Double entry system, keeps a complete

record of business transactions.

2.

This provides complete information regarding the

business.

3.

This has the facility of checking mathematical

accuracy of books of accounts.

4.

It reveals the profit or loss of the business

for a given period.

5.

This enables the business man to plan, control

and take necessary actions in his operations.

6.

It avoids chances of fraud or misappropriation

of accounts.

7.

This system is flexible according to the nature

of business.

8.

This system is accepted by the tax authorities.

9.

Actual net profit can be calculated directly.

Disadvantages

of Double entry system

The important limitations of Double entry

system are as follows:-

1.

It is not suitable to disclose all the

information of a transaction which is not properly recorded in the journal.

2.

If there is any errors in the transactions

recorded in the books, it is difficult to detecting the errors.

3.

This system required more clerical labour.

4.

If there is any compensatory errors, it is not

suitable to find out by this system.

These all are the Advantages and Disadvantages of Double

entry system of accounting.